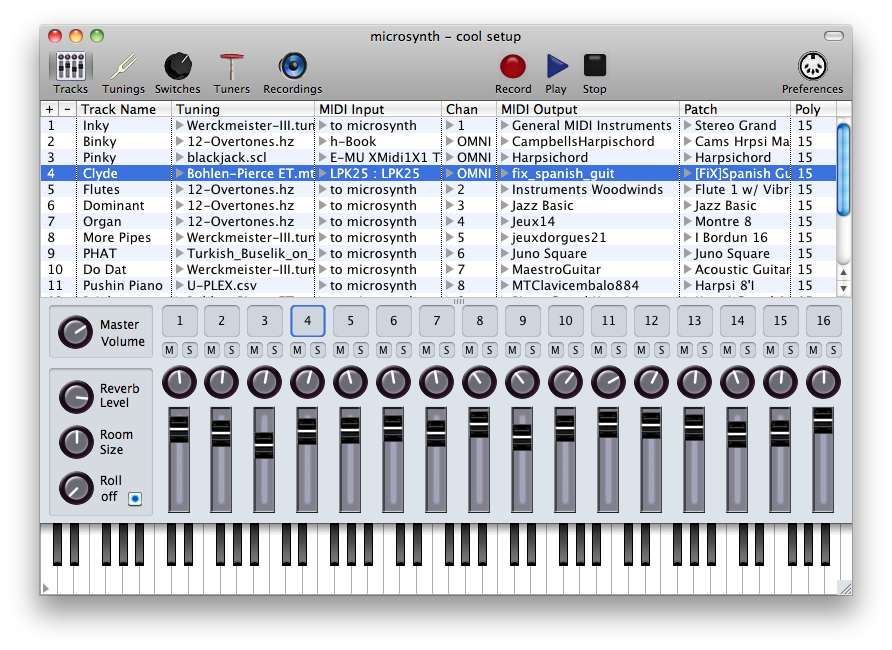

Kvr: H-pi Instruments Releases Microsynth V1.2.2 For Mac

Free Writing Prospectus-iPath VZZB Press Release Free Writing Prospectus Filed Pursuant to Rule 433 Registration No. 333-169119 October 5, 2012 Press Release For immediate release Press Contact: Mark Lane +1 212 412 1413 mark.lane@barclays.com Barclays Bank PLC to automatically redeem the iPath® long enhanced s&P 500 Vix mid-term futures etn (ii) (ticker: VZZB) New York, NY, October 5, 2012 Barclays Bank PLC announced today the automatic redemption of its iPath® Long Enhanced S&P 500 VIX Mid-Term Futures Exchange Traded Note (II) (ticker: VZZB) (the ETNs). The ETNs are being redeemed as the result of an automatic termination event occurring on October 5, 2012, the automatic termination date. As described in the prospectus, an automatic termination event occurs when the intraday indicative note value of the ETNs on any valuation date is equal to or less than the automatic termination level of $10.00. Details of the automatic termination event are below.

Automatic Termination Date: October 5, 2012 Time of Automatic Termination Event: 09:30 a.m. EST Automatic Termination Level: $10.00 Holders of the ETNs on the automatic redemption date, which is the fifth business day following the automatic termination date, will receive a cash payment equal to the automatic redemption value.

Automatic Redemption Date: October 15, 2012 Automatic Redemption Value: Closing indicative value of the ETNs on the automatic termination date (which will not be greater than $10.00 for each ETN, and will not be less than $0 per ETN). For more information regarding the automatic termination event, including how the automatic redemption value is determined, see the prospectus relating to the ETNs under the heading Specific Terms of the ETNsAutomatic Termination Event. The prospectus relating to the ETNs can be found on EDGAR, the SEC website, at: www.sec.gov. The prospectus is also available on the product website at www.iPathETN.com. Barclays moves, lends, invests and protects money for customers and clients worldwide.

With over 300 years of history and expertise in banking, we operate in over 50 countries and employ over 140,000 people. We provide large corporate, government and institutional clients with a full spectrum of solutions to their strategic advisory, financing and risk management needs.

Our clients also benefit from access to the breadth of expertise across Barclays. Were one of the largest financial services providers in the world, and are also engaged in retail banking, credit cards, corporate banking, and wealth and investment management. Barclays offers premier investment banking products and services to its clients through Barclays Bank PLC. For more information, visit www.barclays.com iPath ETNs For further information about the iPath ETNs go to: An investment in the iPath ETNs described herein (the ETNs) involves risks. Selected risks are summarized here, but we urge you to read the more detailed explanation of risks described under Risk Factors in the applicable prospectus supplement and pricing supplement. You May Lose Some or All of Your Principal: The ETNs are exposed to any decrease in the level of the underlying index between the inception date and the applicable valuation date.

Additionally, if the level of the underlying index is insufficient to offset the negative effect of the investor fee and other applicable costs, you will lose some or all of your investment at maturity or upon redemption, even if the value of such index has increased. Because the ETNs are subject to an investor fee and any other applicable costs, the return on the ETNs will always be lower than the total return on a direct investment in the index components. The ETNs are riskier than ordinary unsecured debt securities and have no principal protection. Credit of Barclays Bank PLC: The ETNs are unsecured debt obligations of the issuer, Barclays Bank PLC, and are not, either directly or indirectly, an obligation of or guaranteed by any third party. Any payment to be made on the ETNs, including any payment at maturity or upon redemption, depends on the ability of Barclays Bank PLC to satisfy its obligations as they come due. As a result, the actual and perceived creditworthiness of Barclays Bank PLC will affect the market value, if any, of the ETNs prior to maturity or redemption. In addition, in the event Barclays Bank PLC were to default on its obligations, you may not receive any amounts owed to you under the terms of the ETNs.

Automatic Redemption: If specified in the applicable prospectus, Barclays Bank PLC will automatically redeem a series of ETNs (in whole only, but not in part) at the specified automatic redemption value if, on any valuation date prior to or on the final valuation date, the intraday indicative note value of the ETNs becomes less than or equal to the applicable level specified in the prospectus. The Performance of the Underlying Indices are Unpredictable: An investment in the ETNs is subject to risks associated with fluctuations, particularly a decline, in the performance of the underlying index. Because the performance of such index is linked to futures contracts on the CBOE® Volatility Index (the VIX Index), the performance of the underlying index will depend on many factors including, the level of the S&P 500® Index, the prices of options on the S&P 500® Index, and the level of the VIX Index which may change unpredictably, affecting the value of futures contracts on the VIX Index and, consequently, the level of the underlying index. Additional factors that may contribute to fluctuations in the level of such index include prevailing market prices and forward volatility levels of the U.S. Stock markets and the equity securities included in the S&P 500® Index, the prevailing market prices of options on the VIX Index, relevant futures contracts on the VIX Index, or any other financial instruments related to the S&P 500® Index and the VIX Index, interest rates, supply and demand in the listed and over-the-counter equity derivative markets as well as hedging activities in the equity-linked structured product markets.

Your ETNs Are Not Linked to the VIX Index: The value of your ETNs will be linked to the value of the underlying index, and your ability to benefit from any rise or fall in the level of the VIX Index is limited. The index underlying your ETNs is based upon holding a rolling long position in futures on the VIX Index. These futures will not necessarily track the performance of the VIX Index. Your ETNs may not benefit from increases in the level of the VIX Index because such increases will not necessarily cause the level of VIX Index futures to rise.

Accordingly, a hypothetical investment that was linked directly to the VIX Index could generate a higher return than your ETNs. 2 Press Release For immediate release Press Contact: Leverage Risk: Because an investment in the ETNs is leveraged, changes in the level of the underlying index will have a greater impact on the payout on the ETNs than on a payout on securities that are not so leveraged. In particular, any decrease in the level of the underlying index will result in a significantly greater decrease in the payment at maturity or upon redemption, and an investor will suffer losses on an investment in the ETNs substantially greater than an investor would if the ETNs did not contain a leverage component. Market and Volatility Risk: The market value of the ETNs may be influenced by many unpredictable factors and may fluctuate between the date you purchase them and the maturity date or redemption date. You may also sustain a significant loss if you sell your ETNs in the secondary market. Factors that may influence the market value of the ETNs include prevailing market prices of the U.S. Stock markets, the index components included in the underlying index, and prevailing market prices of options on such index or any other financial instruments related to such index; and supply and demand for the ETNs, including economic, financial, political, regulatory, geographical or judicial events that affect the level of such index or other financial instruments related to such index.

A Trading Market for the ETNs May Not Develop: Although the ETNs are listed on NYSE Arca, a trading market for the ETNs may not develop and the liquidity of the ETNs may be limited, as we are not required to maintain any listing of the ETNs. No Interest Payments from the ETNs: You may not receive any interest payments on the ETNs. Restrictions on the Minimum Number of ETNs and Date Restrictions for Redemptions: You must redeem at least 25,000 ETNs of the same series at one time in order to exercise your right to redeem your ETNs on any redemption date. You may only redeem your ETNs on a redemption date if we receive a notice of redemption from you by certain dates and times as set forth in the pricing supplement. Uncertain Tax Treatment: Significant aspects of the tax treatment of the ETNs are uncertain. You should consult your own tax advisor about your own tax situation. Barclays Bank PLC has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates.

Before you invest, you should read the prospectus and other documents Barclays Bank PLC has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting www.iPathETN.com or EDGAR on the SEC website at www.sec.gov. Alternatively, Barclays Bank PLC will arrange for Barclays Capital Inc. to send you the prospectus if you request it by calling toll-free 1-877-764-7284, or you may request a copy from any other dealer participating in the offering. BlackRock Investments, LLC, assists in the promotion of the iPath ETNs. The ETNs may be sold throughout the day on the exchange through any brokerage account.

There are restrictions on the minimum number of ETNs you may redeem directly with the issuer as specified in the applicable prospectus. Commissions may apply and there are tax consequences in the event of sale, redemption or maturity of ETNs. Sales in the secondary market may result in significant losses. Standard & Poors®, S&P 500®, S&P®, S&P 500® Total Return, S&P 500 VIX Short-Term Futures and S&P 500 VIX Mid-Term Futures are trademarks of Standard & Poors Financial Services, LLC (S&P) and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (Dow Jones). These trademarks have been licensed for use by S&P Dow Jones Indices LLC and its affiliates and sublicensed for certain purposes by Barclays Bank PLC.

Contents. Cloud Tools If you are using a LaunchPad or a SensorTag you can begin working with many of these boards without downloading CCS.

Visit to access Cloud-based development tools. Resource Explorer provides instant access to all of the examples, documentation and libraries, CCS Cloud is a cloud-based IDE and PinMux enables you to select your peripherals and generate the pin configuration. Download the latest CCS Download 8.2.0.00007 Installers ( Offline installer is recommended for slow and unreliable connections) Notes Windows Mac OS Linux 64bit Move to Windows 64bit in 2019 Our current plan is to migrate CCS to be a 64bit application on Windows in 2019. This will mean that it will not work on 32bit Windows systems. People with 32bit Windows Systems would need to stick with CCSv8 or earlier.

Version 8.2.0.00007 Licensing: CCSv8 is Technology Software Publicly Available (TSPA) compliant. This means that it does not require a paid license.: This release will not be available as an update. Mac Users Please note that only microcontroller and connectivity devices are supported on Mac. Processors devices are not support. See for more information. Also if you do not have adminstrative rights on your Mac then you will need to run the installer with a command that looks like this: xattr -r -d com.apple.quarantine ccssetup7.1.0.00016.app (replace the filename with the version you are using). If you do not do that then MacOS will copy the executable to another folder and run it from there, as a result the installer will not be able to find the offline files and will run as a web installer.

Linux Users Please note that that if installed will prevent CCS from starting and RTSC based projects from buiilding. A fix is available in the latest kernel updates. If you are running into the issue, please make sure you have the latest updates applied.

Internet Explorer users may need to change the extension of the Windows installer to exe after downloading. This installation program will allow you to select the features of CCS that you want to install and then will download and install just those items. Are available if you have issues with the web installer. Previous versions are also available.

Kvr H-pi Instruments Releases Microsynth V1.2.2 For Mac

Please see the and pages for device support information as not all devices are supported on these platforms. 4K Display Note (CCS 7.2.0 and earlier) if you are using a 4K display the text will auto scale in the installer which makes it very difficult to read the text displayed within the window area and thus not possible to install CCS. It is recommended to disable text scaling or lower the resolution. Linux GLIBC 2.2.6 (CCS 7.3.0 and earlier) Linux distributions that use GLIBC 2.2.6 (this includes Ubuntu 17.10) will prevent the installer from running. Use a newer version. C55x Users: the C5500 compiler is not installed in CCSv7.x releases, but it is instead available at the CCS App Center, accessible from the View menu in CCS. Check for details.

Free license for older versions With the release of CCSv7 all previous v4, v5 and v6 releases are free of charge. Simply unzip and copy the into /ccsbase/DebugServer/license.

Then go to Help - Code Composer Studio Licensing information and point CCS to this license file. Deprecation notices:.

The 32-bit version of Code Composer Studio for Windows will be discontinued starting with CCSv9.0, where only a 64-bit version will be available. This will happen in 2019.

The 32-bit version of Code Composer Studio for Linux is discontinued in favor of a 64-bit version since CCSv6.2.0. Ubuntu 12.04LTS support is deprecated with the release of CCSv8.0.0. Windows XP support is deprecated with the release of CCSv7.0.0. Spectrum Digital XDS510USB JTAG debuggers are not supported with 64bit CCS installations.

Currently this impacts Linux and MacOS. This will impact the Windows version when CCSv9.0 is released. Stellaris (LM3S and LM4F) devices are not supported starting with CCSv7.0.0. CCS Incremental Update Policy When a new release is posted, it may be possible to incrementally update an existing older version of CCS to the newly released version via the CCS Update Manager. Note that this incremental CCS update will only update the IDE components.

Also note that not every release will have an incremental update available. More details on the CCS update policy is detailed below: CCS Update Policy. Each CCS release, starting with 6.1.2, will have a note regarding availability of an incremental update.

Incremental update availability (if planned) will trail full update releases by no more than 2 weeks. Not every release will have an option for an incremental update. Reasons for this vary. One reason would be if a CCS release picks up a new version of Eclipse (Eclipse itself does not formally support upgrading between releases) Code Composer Studio Version 8 Downloads There are two types of installers:.

Web installers allow you to download only the software components that you require. Off-line installers will download a large compressed file (about 800MB) so you may then uncompress it then select what you require to install.